Algoan Token allows an intermediary (broker, credit institution, etc.) to provide a lender with a creditworthiness assessment based on Open Banking data through a simple API Token.

Only the intermediary integrates the Open Banking aggregation into their user journey and transmits the Token to their financial partners. These partners can then make an API call using the Algoan Token and return a definitive response in real time (approval or rejection of the financing request).

Integration Journey

- The client starts a loan or subscription request through an intermediary (e.g., broker or financial platform).

- The intermediary triggers Algoan to start the process with Transaction Data.

- With the client’s consent, Algoan connects to their bank and retrieves Open Banking data.

- The client’s certified banking transactions and account information are securely retrieved.

- Algoan performs a 360° financial evaluation.

- A unique Algoan Token is generated for this analysis.

- The intermediary shares the token with its finance partners (lenders or banks).

- The finance partner uses the token to make a secure API call to Algoan and retrieves the full analysis and score.

- Based on the analysis, the finance partner returns a decision in real time — approval or rejection of the credit request.

- The decision is delivered back to the client, completing the loop.

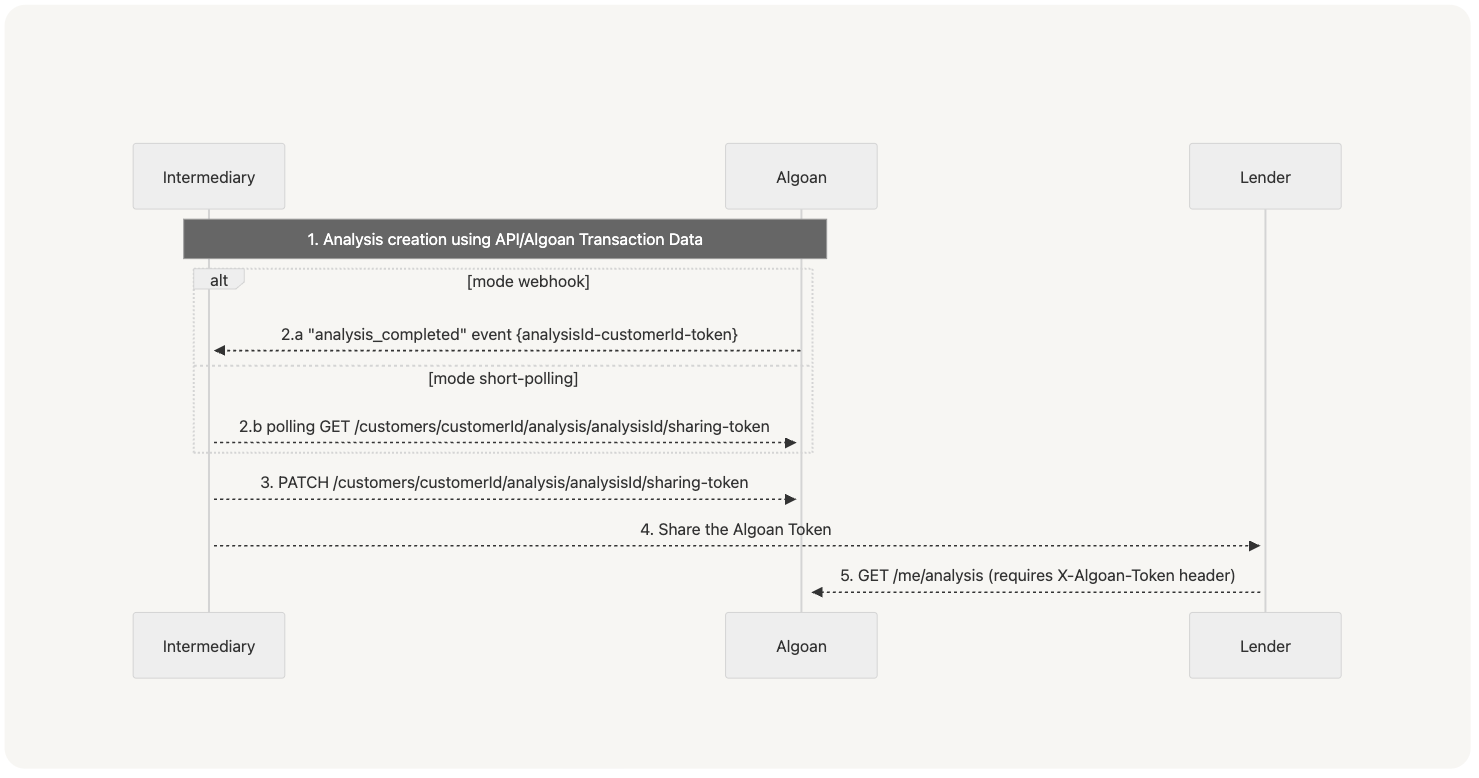

Integration Journey (API summary)

For the intermediary

The intermediary redirects the user to Algoan’s Transaction Data platform.

The intermediary retrieves the Algoan Token via one of the two methods :

- By listening to the "analysis_complete" webhook

- By polling the API : GET

/customers/{customerId}/analysis/{analysisId}/sharing-token

The intermediary updates the list of authorized lenders using:

- PATCH

/customers/{customerId}/analysis/{analysisId}/sharing-token

- PATCH

The intermediary shares the Algoan Token with the selected lenders.

For the lender

- The lender fetches the analysis via: GET

/me/analysis(requires X-Algoan-Token header) - The lender runs its own creditworthiness checks using the data received

- The lender communicates the decision (approval or rejection) back to the intermediary.